Starting Up After 40: When Experience Becomes a Strategic Asset

At the age of 40, many people choose stability. Yet, quite a few choose to begin again — to embark on a new journey called “entrepreneurship.” In reality, starting a business after 40 is far from too late. On the contrary, it can be the ideal moment to launch a venture with a strong foundation: life experience, accumulated capital, and maturity in decision-making.

When 40 Becomes a Competitive Advantage

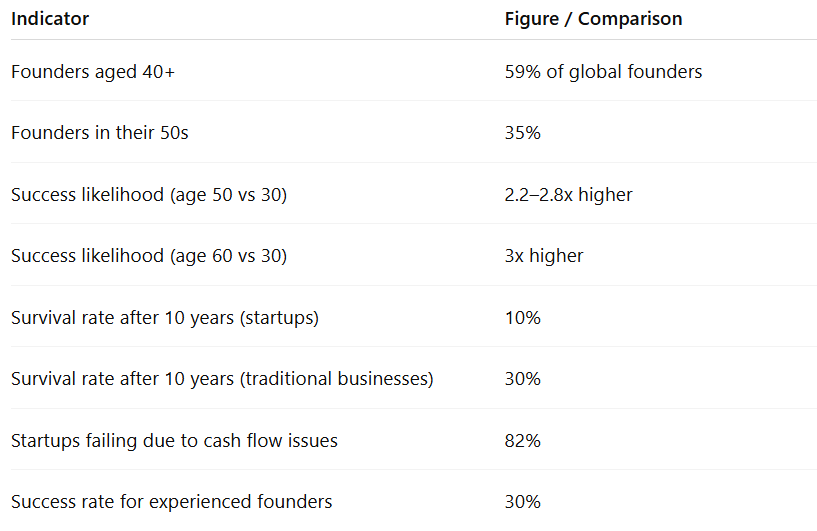

Recent international studies show that 59% of startup founders worldwide are aged 40 or older, and the average age of a successful startup founder is 45. In fact, founders in their 50s are 2.2–2.8 times more likely to succeed, and those in their 60s are three times more likely than their 30-year-old counterparts (Harvard Business Review, 2018; Startup Magazine, 2024).

Why is that? Because by this stage of life, founders have already accumulated:

-

Professional experience that helps them understand the market, customers, and how businesses operate.

-

Risk management and decision-making skills based on real data rather than intuition.

-

Established professional networks — from former colleagues and partners to clients and mentors — providing a strong foundation for fundraising, business expansion, and trust-building.

-

More stable personal finances, reducing early-stage pressure and enabling them to self-fund their ventures.

Real-World Challenges and the “Technology Test”

However, starting up after 40 is not without challenges. Founders in this age group often struggle with adopting digital tools, automating processes, and managing finances using digital systems. As most business operations now happen online, slow technological adaptation can make business models less scalable or competitive.

Studies also show that the riskiest period for startups is not the first year, but years two to five, when 70% of startups fail due to poor cash-flow control or imbalance between growth and cost (Equidam, 2023). Moreover, 82% of startups fail due to ineffective cash-flow management (Brooks-Keret, 2024).

For founders over 40, these risks can be even higher, as many rely on personal savings, retirement funds, or severance packages instead of venture capital — which is typically more flexible.

Financial Management – The Compass for 40+ Startups

To survive and grow sustainably, smart and disciplined financial management is essential.

According to expert Trịnh Phan Lan, founders at this age should:

-

Develop a sound financial mindset, emphasizing savings and risk prevention.

-

Use digital tools to track personal and business finances separately, adopting cloud-based accounting platforms for real-time cash-flow monitoring.

-

Apply financial modeling and risk forecasting tools to evaluate different business scenarios.

-

Build cash-flow reports and detailed forecasts to prepare for potential crises.

-

Set up investor and advisor reporting systems to maintain transparency and strengthen trust.

In other words, finance is not just about numbers — it is a strategic early-warning system for decision-making. With a solid risk management mindset, startups led by founders over 40 can operate as sustainably as traditional businesses after 10 years (StartupRegions, 2020).

© Copyright by KisStartup. Any form of reproduction, citation, or reuse must include proper attribution to KisStartup.